The Land Boomers Take Two: How CBDCs, Crypto and Blockchain Technology are Driving the Land Cycle

- Catherine Cashmore

- Jul 27, 2023

- 5 min read

Updated: Apr 6, 2025

In the late 1800s, Melbourne was heralded as ‘Marvelous Melbourne’. It was experiencing the biggest boom Australia had ever seen.

Immigrants discovered large nuggets of gold in areas such as Castlemaine and Bendigo.

They poured their wealth into the real estate market.

By 1889, the value of land in parts of central Melbourne was as high as that in London. The most successful developed an intricate web of land banks, mortgage companies, and building societies.

It was all set up on a web of complex cross-ownership and financial arrangements. As long as confidence was held, the boom in land values kept growing. It was all fuelled by speculation in land and shares in the companies that backed it.

‘Thousands of acres of suburban land were subdivided and resold many times, each time at a higher price…anyone, it seemed, could make a fortune in this incredible economy’. ‘[Everyone] grasped at the chance of quick wealth and invested their savings. Many borrowed widely to invest more than their assets were worth, and later formed a pitiful kite-tail to the catalogue of insolvencies.’ – Michael Cannon, The Land Boomers

The downturn that followed (at the end of the 18-year cycle in the 1890s) was the deepest and longest Australia ever weathered.

It was worse than the downturn during the 1930s Great Depression — worse than the downturn in the early 1990s, worse than anything we’ve seen since.

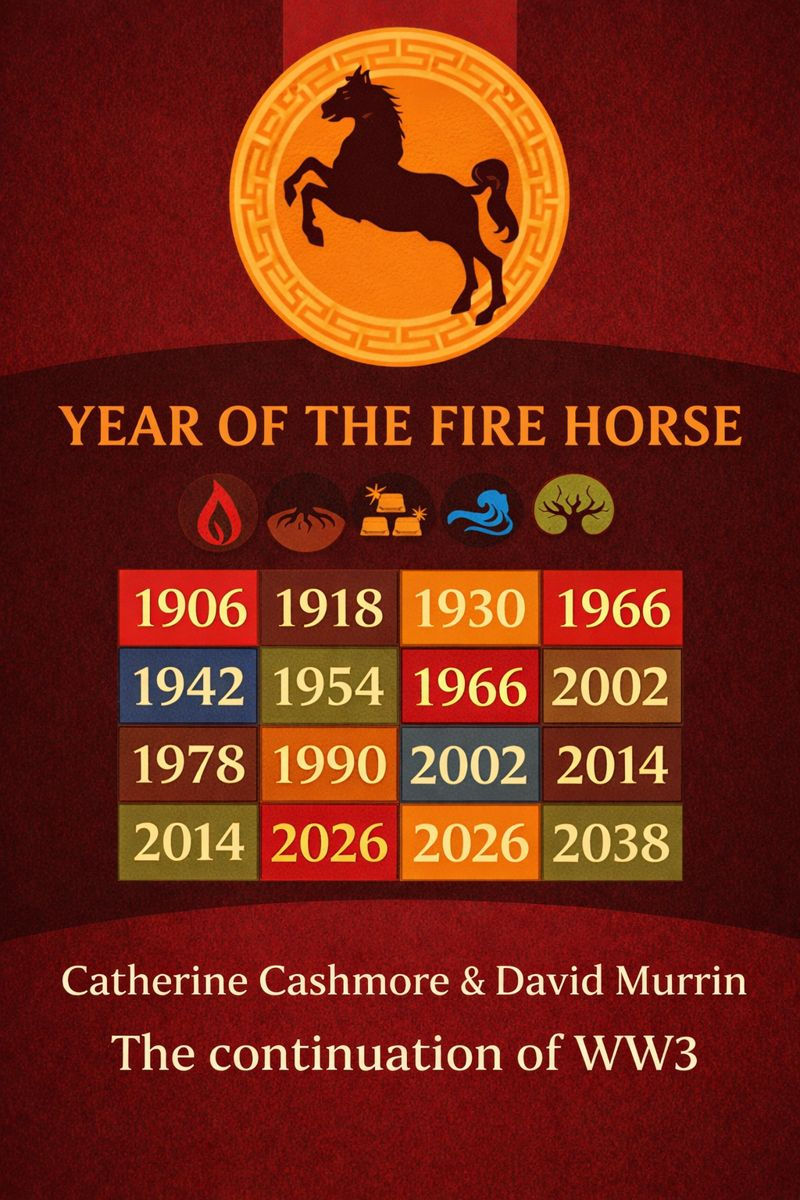

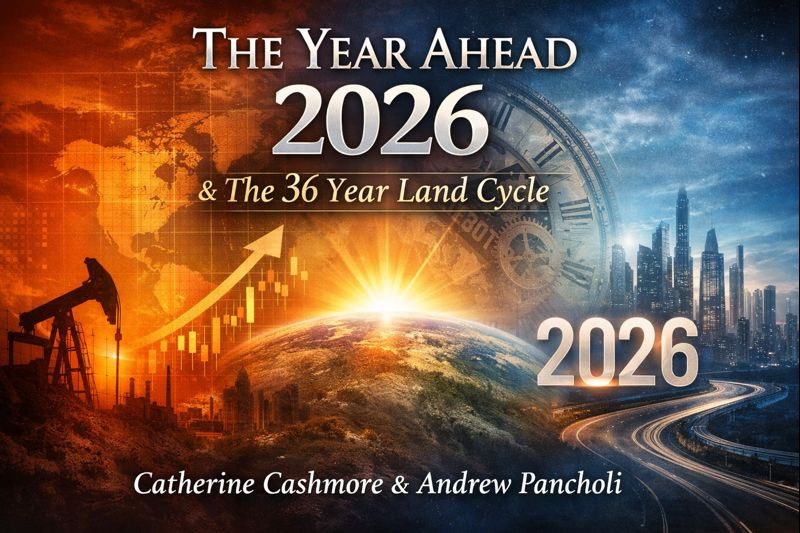

Today, it’s not gold mining that is going to drive the land cycle. Rather, the mining of cryptocurrencies — and the blockchain technology that supports it.

We’re witnessing the start of the effects of the ‘war on cash’ right now.

The principal aim of the ‘war on cash’ is to shift transactions to solely digital — leaving an electronic data trail for law enforcement and tax authorities. And that’s a scary proposition.

It is a pathway to enable easy tracking of citizens from cradle to grave. The ultimate form of control in our increasingly technocratic society. A plan in the making for decades.

It will complete a cycle of indoctrination over the information you consume, with punishments for those that step outside of the dictated boundaries.

If you still think this is a little far-fetched — ‘couldn’t possibly happen in a great democracy like Australia’ — take a look at a blog written by the International Monetary Fund (IMF) in December 2020.

IMF researchers are calling for internet search history to be tied to citizens’ credit scores.

They argue that using ‘the history of online searches and purchases,’ can solve the problem of ‘certain kinds of people not having enough hard data (income, employment time, assets and debts) available’ to buy products.

It’s a ‘great monetary reset’ — but it will not stop the cycle.

Truth be told, the economy and society itself cannot go forward as long as you have a financial oligarchy that rules this system.

Those that control the money, control the people.

You cannot have both a financial oligarchy and democracy.

Against the outcries of public opposition, the banks will always be bailed out in a crisis.

Policies will always be employed to assist landowners, and never the labourers.

While this system exists, the cycle will repeat as it has done for centuries.

New monetary technology will only feed the cycle.

Want to read more?

Subscribe to landcycleinvestor.com to keep reading this exclusive post.